Claim Tax Benefits

Simple filing for quicker benefits

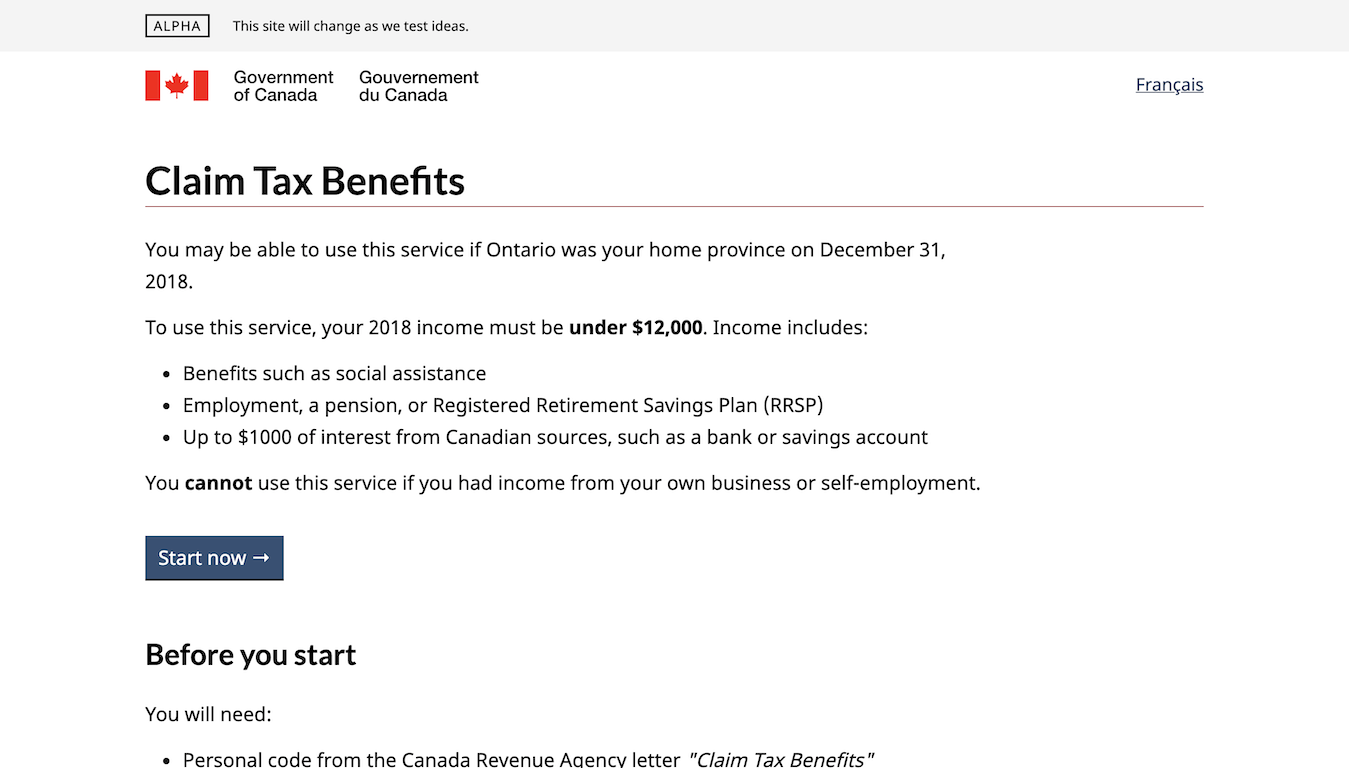

Between November 2018 and January 2020, I was Technical Lead on a moonshot Canadian Digital Service (CDS) project to improve the way Canadians file tax returns. Moving from an organizational discovery to prototyping to testing with citizens, the service trialled expedited filing for low-confidence tax-filers in Ontario.

As the lead technologist on the team, I was responsible for delivering a resilient and accessible service to test with Real Canadians™, for setting up longer-term practices (CI/CD, our sweet suite of tests), and for integrating with the legacy infrastructure at the Canada Revenue Agency (CRA). It was a big role, though the day-to-day depended on the phase of the project.

During the Discovery, my focus was on the archeology of our partner department: who are we working with? how do they plan their work? what systems are implicated? what are the constraints? The reports I wrote elaborated the context and made the case to move forward.

In the Alpha phase, myself and the CRA Service Owner came up with the initial concept, which we then refined with our Service Designer. I built various initial prototypes using different technology stacks to find a balance between the preferences of our modern dev shop and CRA’s legacy environment.

While working towards a live Beta, I led a small but capable team of interdepartmental developers in building a snappy and accessible Node app that was continuously tested and deployed inside of CRA’s Azure cloud lab.

The technical challenge was to define a stack whose citizen-facing side could accommodate quick changes on top of a mainframe system that absolutely could not. To resolve this tension, I designed a containerized JS frontend and a backend Java API to translate our data into the format expected by CRA.

Unfortunately, the service was not launched as we anticipated in 2020. However,the government has since committed to releasing an automated benefits filing system for people with “simple tax situations”, which was almost literally the tagline of our project:

“The Canada Revenue Agency (CRA) will prepare a pre-filled tax return in My Account for about 1 million individuals with simple tax situations starting in 2027.”

Claim Tax Benefits was an ambitious project aiming to redefine how an important government service could be built and delivered: quickly and incrementally, using real citizens to guide the process. While it didn’t achieve its ends in the short term, our public reseach and code repository have served as inspiration and guidance for the new, upcoming automatic filing system.